Indulging in a bit of responsible fun this festive season

Budgeting , Festive season , Values & Money , Responsibility in Spending , Wisdom in BorrowingThe Christmas decorations went up ages ago and we are all in the mood to start winding down from work and spend time and money on our loved ones. But this year has been filled with steep increases. We’ve experienced multiple interest rate hikes and food prices have skyrocketed, but our salaries have stayed the same.

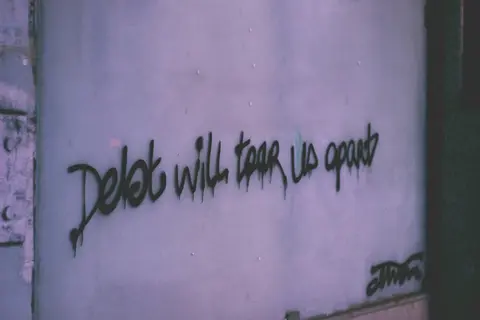

Despite all these cost increases, we tend to lose ourselves and get carried away over the festive season by going overboard without having a proper plan in place. Whether it’s the last minute braai on the Day of Goodwill, or splurging on expensive clothes and costly alcohol that you hadn’t planned for, it’s easy to lose control of your budget. And this can unfortunately have devastating effects on how you start your 2023 financial year.

The average South African household spends most of its budget on food, transport and household expenses, so there is not much – or in many cases, any – money left for entertainment and gifts, especially when you add other living expenses into the mix. However, there are ways to ensure that you cover all your monthly expenses and still have some cash to spare to make your holiday special.

If you, like most people, are relying on your thirteenth cheque or bonus to get you over the next few weeks, it’s important to save some of it in order to carry you over the ‘Janu-worry’ period.

So, what can you do to make sure that you keep within your budget this December? Here are a few tips that can help you get 2023 off to a good financial start.

1. Budget for your essentials first

When the holiday spirit kicks in, it’s easy to forget about Janu-worry and February. So, before splashing out on a new wardrobe, over-the-top Christmas spreads and expensive alcohol (all in the name of keeping up appearances for the ‘gram), make sure that you’ve covered all the essentials like rent, school fees, transport, groceries and other living expenses.

2. Put your credit card away

That little card can be so tempting, but before whipping out your plastic money, ask yourself: Can I afford to pay back my credit expenditure in full before it accrues interest? Am I spending within my means or am I trying to impress my family and social media following? If the answer to either of these questions is ‘No’, please put your credit card back in your wallet.

3. Have a plan for those tempting conveniences

You work really hard throughout the year so that you can afford some of life’s conveniences. We want a ‘soft life’ and the holidays can be a time when logic goes out the window and convenience purchases become all the more tempting. You can help prevent this with simple tools like limiting your spending on takeaways and prepping extra meals ahead of time for the days when you don’t feel like cooking.

Remember, keeping your spending in check during the holidays is not about depriving yourself, but about making responsible choices and compromising to benefit yourself in the long run.

So, as you go out and spend your hard-earned money this festive season, remember to spend it wisely so you don’t have to run to lenders in new year just to get through January.

Bonolo Mokua

Bonolo is a multimedia journalist and content creator at Heartlines. She has experience in online and radio media production and helps spread the Heartlines message on multiple platforms.

Featured