How to save during any season

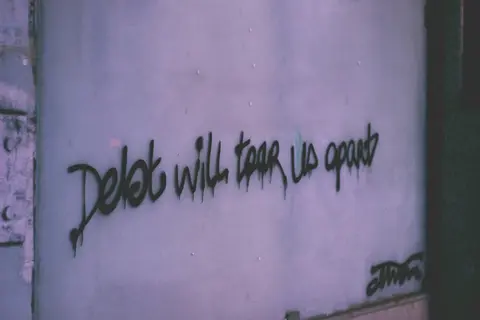

Self Control in Saving , Values & MoneyAs South Africans we are definitely known for our resilience and our ability to ride out storms. But one thing we aren't known for is being a "nation of savers". Why do we find it so hard to save?

Have you noticed how on payday many of us have a spring in our step, an unexplainable “glow” if you will? Ever wondered why? Well that's because we equate money with having a sense of freedom, power, possibility, choice and security. Now imagine having a sense of security that doesn’t end five days after payday – because that's how long it takes for an average middle-income consumer to spend up to 80% of their monthly salary.

It takes an average middle-income consumer only five days to spend up to 80% of their monthly salary.

According to research by FNB, the average middle-income consumer, earning between R180 000 – R500 000 a year, survives on 20% of their monthly salary for more than 20 days in a month.

We thought it would be interesting to look at how an average South African household navigates the cost of living. We spoke with four households that earn an average of R25 000 per month and they shared the money saving tips they have learnt.

Saving begins with keeping a budget

Hope* is a 33-year-old single man who shares an apartment with his sister in the south of Johannesburg. This is how he spends his monthly salary of R25 000. Hope says that he likes to help out at home and, on a monthly basis, he sits down with his sister and they first plan their “finances as individuals for the month and then consolidate what the family budget will look like together”. By doing this Hope says he is able to “anticipate if I may need to cover some of her expenses if she won’t have enough to cover her expenses.”

Single person's budget

| Item | Amount |

|---|---|

| SAVINGS | |

| Emergency Savings | R1 000 |

| Long-term Savings Goal | R1 500 |

| Sub-total | R2 500 |

| FIXED EXPENSES | |

| Vehicle payment | R3 000 |

| Rent/bond | R5 600 |

| Fuel/Transportation | R2 000 |

| Water & Electricity | R 500 |

| Cell Phone | R 500 |

| Sub-total | R11 600 |

| FLEXIBLE EXPENSES | |

| Groceries | R3 000 |

| Personal Care | R 500 |

| Entertainment | R2 000 |

| Takeaways | R 500 |

| Clothing | R1 500 |

| Other | R1 000 |

| Sub-total | R8 500 |

Saving as a single mom

Lebogang* is a 30-year-old single mom who lives in the north of Johannesburg and this is her monthly budget.

Single mom's budget

| Item | Amount |

|---|---|

| SAVINGS | |

| Emergency Savings | R 500 |

| Long-term Savings Goal | R1 000 |

| Car Savings | R 500 |

| Retirement Annuity | R1 000 |

| Sub-total | R3 000 |

| FIXED EXPENSES | |

| Vehicle payment | R5 000 |

| Rent/bond | R7 000 |

| Car Insurance | R2 500 |

| Subscriptions (Netflix, Showmax etc.) | R 500 |

| Fuel/Transportation | R1 000 |

| Hospital Plan | R 500 |

| Sub-total | R16 500 |

| FLEXIBLE EXPENSES | |

| Groceries | R2 500 |

| Childcare | R 400 |

| Entertainment | R1 000 |

| Takeaways | R 500 |

| Clothing | R 500 |

| Other | R 500 |

| Sub-total | R5 500 |

Lebogang’s savings tip is to always put away whatever is left over from the month into her emergency account. That way, she has money if her son needs medical attention or she needs to pay for after-hours babysitting services when she attends to her freelance job as an event photographer.

A father’s advice on saving

Ronald* is a 49-year-old father of three and he says that the first thing he does is “cover all my needs – and this includes buying food and paying my monthly debts (account and loans), transport, monthly bond installment and school fees.” The last thing he does is save and invest some money before spending the rest on activities that he enjoys doing like running in marathons.

Father of three's budget

| Item | Amount |

|---|---|

| SAVINGS | |

| Emergency Savings | R1 000 |

| Long-term Savings Goal | R5 000 |

| Sub-total | R6 000 |

| FIXED EXPENSES | |

| Vehicle payment | R4 600 |

| Rent/bond | R6 000 |

| Car Insurance | R2 500 |

| Subscriptions (Netflix, Showmax etc.) | R 500 |

| Fuel/Transportation | R1 000 |

| Hospital Plan | R 500 |

| Sub-total | R14 800 |

| FLEXIBLE EXPENSES | |

| Groceries | R2 000 |

| Entertainment/Hobbies | R 500 |

| Takeaways | R 500 |

| Clothing | R 800 |

| Sub-total | R3 800 |

A student’s guide to saving

Thabang*, a 22-year-old currently studying towards his honours degree in accounting spends the following with his salary:

Student's budget

| Item | Amount |

|---|---|

| SAVINGS | |

| Emergency Savings | R 500 |

| Long-term Savings | R2 000 |

| Retirement Annuity | R1 500 |

| Sub-total | R4 000 |

| FIXED EXPENSES | |

| Student Loan | R7 000 |

| Transportation | R2 500 |

| Subscriptions (Netflix, Showmax etc.) | R 99 |

| Water & Electricity | R 500 |

| Wi-Fi | R300 |

| Other – Gym | R 892 |

| Sub-total | R11 291 |

| FLEXIBLE EXPENSES | |

| Groceries | R3 000 |

| Family Responsibility | R4 000 |

| Entertainment | R1 000 |

| Clothing | R1 000 |

| Sub-total | R9 000 |

Thabang’s money saving tip is to be firm when it comes to

sending/spending money on his family. He says that “creating that

boundary has made sure that he is able to pay off his student loan

quicker”.

We see it with our friends, colleagues and family who cannot maintain their lifestyle without taking on debt. If we are ever to change our habits and mindset towards saving we need to start prioritizing security over accumulation.

Remember that changing your mindset about saving is a journey, and it requires patience and persistence. Celebrate your progress along the way, and remember that every small step counts towards a more secure financial future.

*Names have been changed.

Bonolo Mokua

Bonolo is a multimedia journalist and content creator at Heartlines. She has experience in online and radio media production and helps spread the Heartlines message on multiple platforms.

Featured