30% of South Africans are living in debt

Values & Money , Wisdom in Borrowing , Responsibility in Spending , Self Control in SavingRaised by a single mother with three siblings in Limpopo, Adivhaho Makhado says the culture of stokvels among black women taught him the responsibility of saving. His mother was a member of three stokvels, one with colleagues, another with friends and a third with women in their community.

The National Stokvel Association of South Africa best describes a stokvel as a type of credit union in which a group of people agree to meet monthly or weekly in order to save together. Each member receive the lump sum on a rotational basis, and they are free to use the money for any purpose.

Adivhaho says the stokvel payout that his mother received annually was a life-line and she would use it to pay for major expenses such as renovating the house and saving up for his tertiary education, he says his mother’s stokvels taught him the basic principles of saving and how important it is to save to achieve your goals.

“My mother worked as a domestic worker in the municipality offices and struggled to make ends meet every month. As children we would go to school with very little pocket money, if any. At the age of 18 I got a part-time job so that I could take care of my own financial needs. I understood the importance of saving from a young age and opened my first bank account when I was in high school,” he adds.

Adivhaho works as a programme assistant at the SABC as well as a Values & Money facilitator at Heartlines.

He believes that failure to save for financial emergencies has hit many South Africans hard during the COVID-19 pandemic, because of its economic impact on people’s livelihoods with some experiencing job loss and others being affected by pay cuts.

“Saving is like taking out insurance, you never know when you might need it but when you do it’s guaranteed to pay out.”

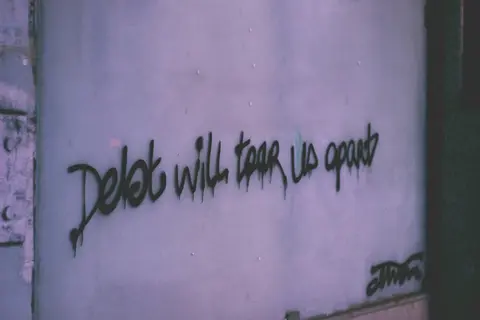

In the conversations he’s had on money values with listeners, he’s come to believe that the biggest problems South Africans have when it comes to managing their finances are living in debt and failure to budget. “30% of South Africans are living in debt,” he says. “We need to learn how to manage our finances better and set up a budget because it helps us control our spending.”

Adivhaho adds that the disadvantage for many black South Africans when it comes to managing their finances is having to overcome generational poverty, and those who break out of the cycle of poverty are left with the responsibility of being bread winners.

“From the early stages of one’s career, one is faced with “Black Tax” which is the portion of their income many black professionals give to their families to support them”, he says. “Also, one of the first achievements for a young black person is buying a car when they start working and that puts them in immediate, long-term debt.”

The conversations he has about money go beyond radio.

“I always ensure that if I get involved in any discussions, mostly with colleagues, friends, and acquaintances, I share my knowledge and best advice about money and debt,” he says.

“When given the opportunity at my church to talk to youth, I always encourage them not to live beyond their means as well as advise them to avoid unnecessary financial pressure from their peers.”

Of the five Heartlines money values, Adivhaho says he lives the most by Generosity in Giving. “Based on my religious background, I believe in sharing the little that I have with others. I believe that by giving I’m making a difference in someone’s life and by doing so I also benefit,” he says.

“When it comes to money, educate yourself, respect it and if you want to get out of poverty and have peace of mind, save and don’t rely on one stream of income.”

He encourages South Africans to open an investment account which requires notification if you want to withdraw from it. “It’s not easy to save, and when you have money you’re tempted to spend it. I recently set up an investment account that will help me save for five years in order to reach my financial goal,” he adds.

Featured