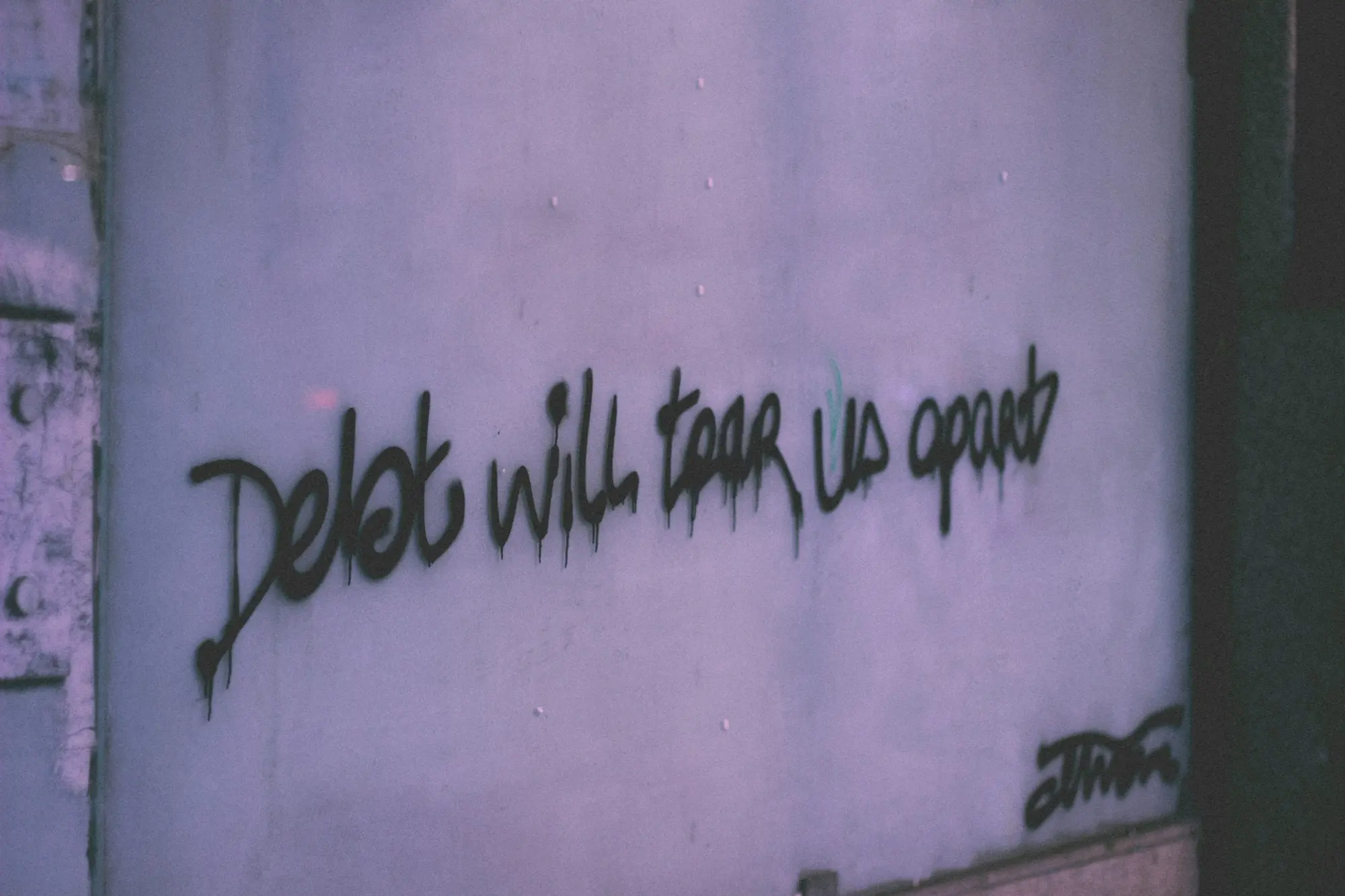

Resolve to cut your debt this year

Values & MoneyBy Zanele Sabela

Khensani Mlangeni has only one New Year’s resolution - to cut up her credit card. “A year ago I cut up my credit card because I wanted to pay it off and get rid of the debt. And I did,” Mlangeni says, “There was only problem – I had two.”

Now she plans to pay off the remaining one. “I’ve decided to cut it off because I can’t stop using it.”

Mlangeni says although she pays in four times more than the minimum required installment, she ends up spending it because the available balance gives her the perception she has money. However, lately she has been asking herself, “Do I really need to buy this?” As a result she has resolved to use her debit card for new purchases. “I’ll only use money I actually have.”

Mlangeni has set herself a deadline to pay off her card debt.

Releasing credit bureau statistics in December, National Credit Regulator (NCR) CEO Nomsa Motshegare warned consumers against reckless spending and slipping further into debt. The figures for the third quarter of 2013 revealed that of the 20.29 million credit active South Africans, 9.76 million (48.1%) have fallen behind on their repayments. According to CEO of Sandton Debt Counselling, Jo (corr) Stone, 4.2 million of those are three months in arrears. In addition, his company has seen a 200% rise in new applications since November. “Now with the latest petrol price increase on 1 January and things getting more expensive, we foresee a bad year for consumers,” he says.

Buying on credit

Thami Bolani, chairman of the National Consumer Forum (NCF), says middle class consumers, in particular, have built their lives on credit. “They buy everything - cars, property, clothing and even food - on credit,” he says.

Consumers, the NCF chair says, were already overextended due to reckless borrowing before the establishment of NCR. “Now the chickens have come home to roost.”

Bolani blames credit providers for irresponsible lending but applauds the Department of Finance for bringing in stricter regulations to protect consumers.

For those buckling under debt stress, Bolani recommends debt consolidation. The process entails taking out one big loan to pay off various smaller accounts effectively leaving one debt account, making it easier to administer.

While consolidation has been widely criticised as a method of tackling debt, Bolani says the trick lies in being disciplined. “Having consolidated, consumers should avoid accessing new debt,” he says.

But Stone disagrees saying the problem with consolidation is that it attracts high interest rate charges. Predictably, he recommends overcommitted consumers contact a debt counsellor. “They will negotiate lower installments and interest rates on behalf of the client. In some cases we’ve succeeded in bringing down interest rates from 8% to 3% on secured loans and from anything between 17% and 35% to zero interest on unsecured loans.”

Get help

Stone advises consumers not to wait until they are in arrears for three months before contacting a counsellor because by then, the credit granter is likely to have issued a letter of demand, making it difficult but not impossible for a debt counsellor to get involved. Conventional wisdom advises consumers speak to credit providers when experiencing difficulty paying as this will provide some relief and breathing space for a time. However, Stone says this will not lower interest charged or installments due the way intervention by a counsellor can.

A lawyer by qualification, Stone warns consumers from willy-nilly signing documents from debt collectors. Some, he says, have been duped into giving consent for garnishee orders on their bank accounts.

He also urges consumers to be extra vigilant when it comes to secured loans for assets like cars and property. “Don’t sign any documents giving consent for your car to be repossessed. Remember your car cannot be repossessed without a court order.” For a house it can take up to a year for the high court to issue such an order, Stone says.

Getting in touch with a debt counsellor doesn’t necessarily mean going under debt review. Counsellors are also a great source of advice and can help you structure a realistic budget if you are “living like a king but not paying for it,” Stone says.

But he urges consumers to be cautious when choosing a counsellor – first check if they are registered on the NCR website and then see if there are any complaints on Hellopeter.co.za.

The first and at times the second negotiated installments go towards the debt counsellor’s payment. Any legal fees arising are also for the consumer’s account.

Stone’s final words of advice: “Don’t put your head in the sand. Get help.”

* This article is part of a series produced to support the Heartlines Values & Money campaign to encourage South Africans to think about how they earn, spend, save, borrow and give away their money.

This article was first published in the NEW AGE on 17 January 2014.

Featured